NY OSC AC92 1994-2024 free printable template

Show details

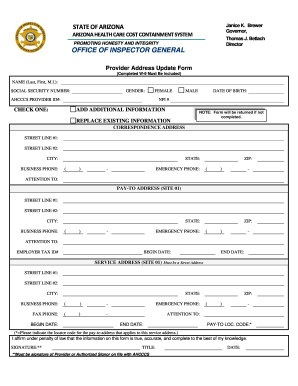

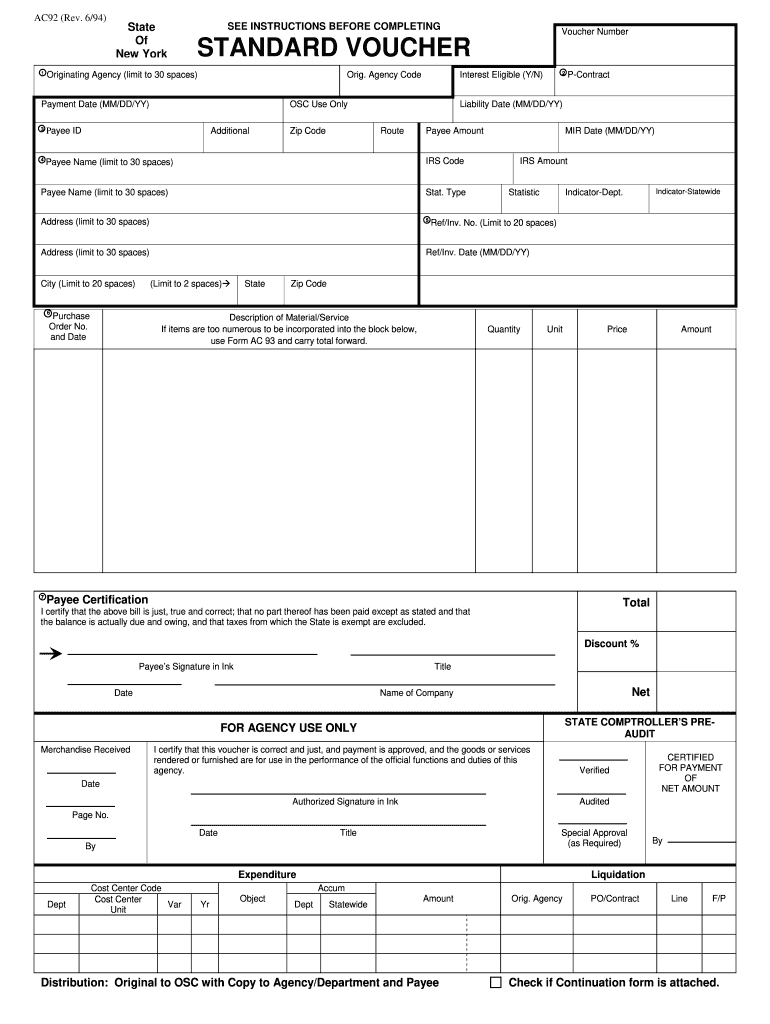

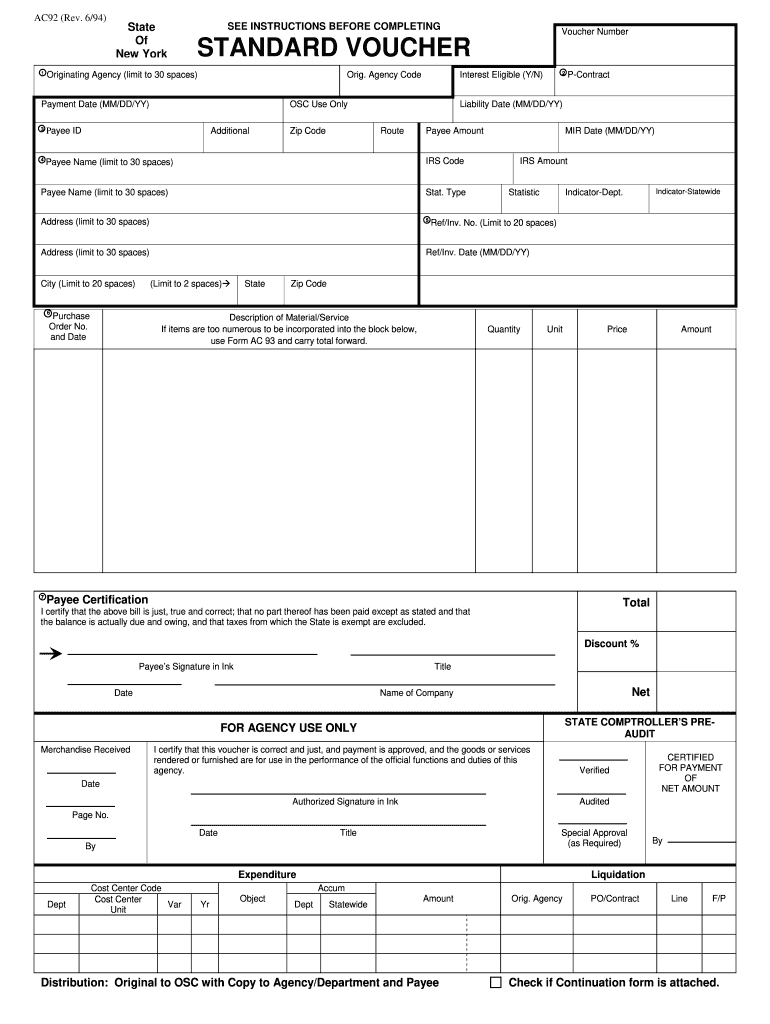

AC92 Rev. 6/94 State Of New York SEE INSTRUCTIONS BEFORE COMPLETING Voucher Number STANDARD VOUCHER Originating Agency limit to 30 spaces Orig. Agency Code Payment Date MM/DD/YY Interest Eligible Y/N OSC Use Only Payee ID Additional Zip Code P-Contract Liability Date MM/DD/YY Route Payee Amount MIR Date MM/DD/YY Payee Name limit to 30 spaces IRS Code Stat. Type Address limit to 30 spaces Ref/Inv* No* Limit to 20 spaces Ref/Inv* Date MM/DD/YY City Limit to 20 spaces Limit to 2 spaces Purchase...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ny state voucher form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ny state voucher form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ny state voucher online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit voucher form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out ny state voucher form

To fill out a NY state voucher, follow these steps:

01

Obtain a NY state voucher form. You can typically find these forms online on the official website of the New York State Department of Taxation and Finance.

02

Begin by entering your personal information, such as your full name, Social Security number, and contact details, in the designated fields on the form.

03

Provide details about your current residency, including your address and the dates during which you resided in New York state.

04

Report your income for the corresponding tax year. This includes wages, self-employment income, rental income, and any other sources of income that are subject to New York state taxes.

05

Deduct any eligible expenses or deductions, such as student loan interest, medical expenses, or contributions to retirement accounts, as applicable.

06

Calculate your New York state tax liability by following the instructions provided on the form. This may involve referring to accompanying tax tables or using a tax software program.

07

Review your completed voucher for accuracy and ensure that all required fields have been filled in correctly.

08

Sign and date the voucher to certify the information provided is true and accurate to the best of your knowledge.

Who needs a NY state voucher?

01

Individuals who have resided in New York state during the tax year and are required to file a New York state tax return.

02

Taxpayers who have earned income from sources within New York state and need to report and pay their state income taxes.

03

Anyone who is eligible for certain deductions or credits available on the NY state voucher and wishes to claim them to potentially reduce their tax liability.

Please note that it is always recommended to consult with a tax professional or refer to the official instructions provided with the NY state voucher to ensure accurate and compliant filing.

Fill state vouchers ny : Try Risk Free

People Also Ask about ny state voucher

What is the difference between Form 1040 and it-201?

How to print 1040 es vouchers?

What is a it-201 form?

What is an IT-203 form?

What does Form It-201 mean?

What is the difference between NYS IT-201 and 203?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ny state voucher?

A "NY state voucher" is a type of document or coupon issued by the government of New York State that can be used to receive a specific benefit or service. These vouchers are typically provided to eligible individuals or organizations and can be exchanged for goods, services, or discounts. The specific purpose and terms of the voucher will depend on the program or initiative for which it is issued.

Who is required to file ny state voucher?

Individuals who have earned income in the state of New York and meet certain filing requirements are required to file a New York state voucher. This includes residents of New York who have a filing requirement for their federal income tax return, non-residents who have New York source income and meet the filing threshold, and part-year residents who have both New York source income and meet the filing threshold. Additionally, individuals who are claiming credits or have a refund due may also be required to file a New York state voucher.

How to fill out ny state voucher?

To fill out a New York state voucher, follow these steps:

1. Obtain a copy of the voucher form: You can find the voucher form online on the official website of the New York State Department of Taxation and Finance or obtain a physical copy from their office.

2. Read the instructions: Carefully read the instructions provided on the voucher form. Ensure that you understand the requirements and eligibility criteria for filing the voucher.

3. Fill in your personal details: Provide your full name, address, Social Security number (SSN), and any other requested personal information in the designated spaces on the form.

4. Determine the tax year: Indicate the tax year for which you are filing the voucher. For example, if you are filling out a voucher for your 2021 state tax payment, write "2021" in the appropriate section.

5. Calculate the tax amount: Calculate the amount of tax you owe based on the instructions provided. This includes any deductions or credits that may apply to your situation.

6. Provide payment information: Indicate the payment method you choose (such as check, money order, or credit card), along with any necessary details. If paying by check or money order, make it payable to the "Commissioner of Taxation and Finance."

7. Double-check your entries: Before submitting the voucher, double-check all the information you have provided to ensure accuracy. Mistakes or incomplete information may lead to processing delays or penalties.

8. Send the voucher: If filing by mail, detach the voucher from the form along the perforated line. Place the voucher and payment in an envelope, affix appropriate postage, and mail it to the address specified on the form. Alternatively, if you are filing electronically, follow the instructions provided for online submission.

Remember to keep a copy of the filled-out voucher for your records. It is also advisable to keep proof of payment, such as a copy of the canceled check or a transaction receipt if paying electronically.

What is the purpose of ny state voucher?

The purpose of the NY State voucher, or NY State Education Department (NYSED) voucher, is to provide financial assistance to eligible students and families in New York State. These vouchers, also known as tuition reimbursement or scholarships, are primarily offered to students with disabilities who require specialized education or related services not available in their public schools. The voucher program aims to ensure that all students have access to appropriate educational opportunities, regardless of their special needs or disabilities. The vouchers can be used to cover tuition costs at approved private schools or programs that cater to students with disabilities.

What information must be reported on ny state voucher?

The information that must be reported on a New York State voucher may vary depending on the specific voucher program or agency. However, generally, the following information may be required:

1. Vendor Information: The name, address, and contact details of the vendor or service provider.

2. Payment details: The amount of payment requested, including any taxes and fees.

3. Description of goods or services: A detailed description of the goods or services provided.

4. Purchase order or contract number: If applicable, the voucher may require the inclusion of a purchase order or contract number.

5. Dates: The dates of the transaction, including the date of the voucher request.

6. Employee information: If the voucher is related to employee expenses, it may require the inclusion of employee details such as name, department, and employee identification number.

7. Approval and authorization: The voucher may require the signature or approval of the person authorized to authorize payments, such as a supervisor or department head.

8. Supporting documents: Depending on the program or agency, the voucher may need to be accompanied by supporting documents such as receipts, invoices, or other proof of purchase.

It is important to note that the specific requirements may vary, and it is advisable to refer to the specific guidelines or instructions provided by the voucher program or agency to ensure compliance.

What is the penalty for the late filing of ny state voucher?

The penalty for the late filing of a New York State voucher can vary depending on the specific circumstances and the agency or department involved. Generally, late filing penalties can include additional fees, interest charges, or a reduction in benefits or payments. It's important to consult the specific agency or department's guidelines or contact them directly for accurate and up-to-date information on penalties for late filing.

Can I sign the ny state voucher electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your voucher form and you'll be done in minutes.

Can I create an electronic signature for signing my state york voucher in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your nys voucher form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit ny id on an iOS device?

Use the pdfFiller mobile app to create, edit, and share new york standard form from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your ny state voucher form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State York Voucher is not the form you're looking for?Search for another form here.

Keywords relevant to new york voucher form

Related to ac92 standard voucher

If you believe that this page should be taken down, please follow our DMCA take down process

here

.